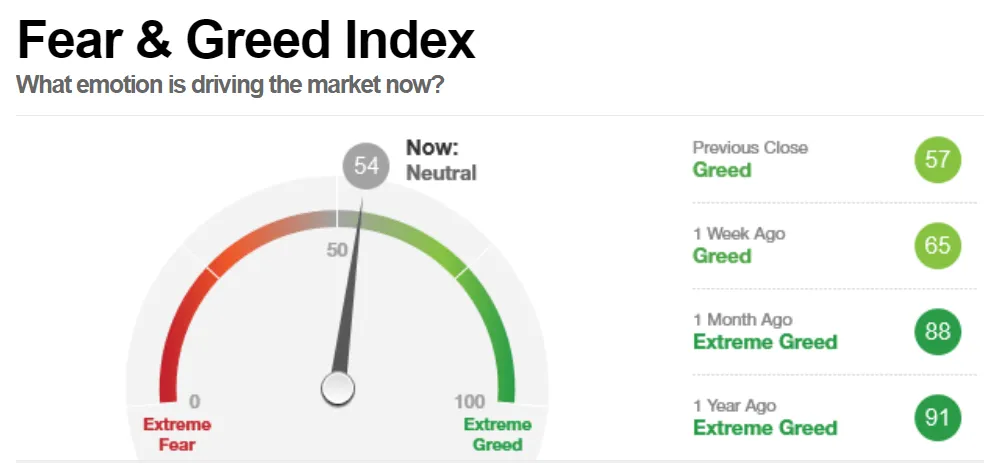

To choose the best stock market strategies in 2026, start by clearly understanding your financial goals, time horizon, and how much risk you can handle, because the “best” strategy depends more on you than on the market itself. In 2026, many investors are combining long-term approaches like diversified index investing, dollar-cost averaging, and quality growth or dividend stocks with selective exposure to strong themes such as technology, AI, healthcare, and sustainable businesses. Diversification across sectors and countries remains important to reduce risk, while regular portfolio review and rebalancing help manage volatility. Instead of chasing hype or short-term trends, focus on companies with solid fundamentals, consistent earnings, and reasonable valuations, and use simple risk-management rules if you trade actively. Overall, a balanced strategy—mixing patience, diversification, and discipline—is more reliable in 2026 than trying to predict quick market moves.