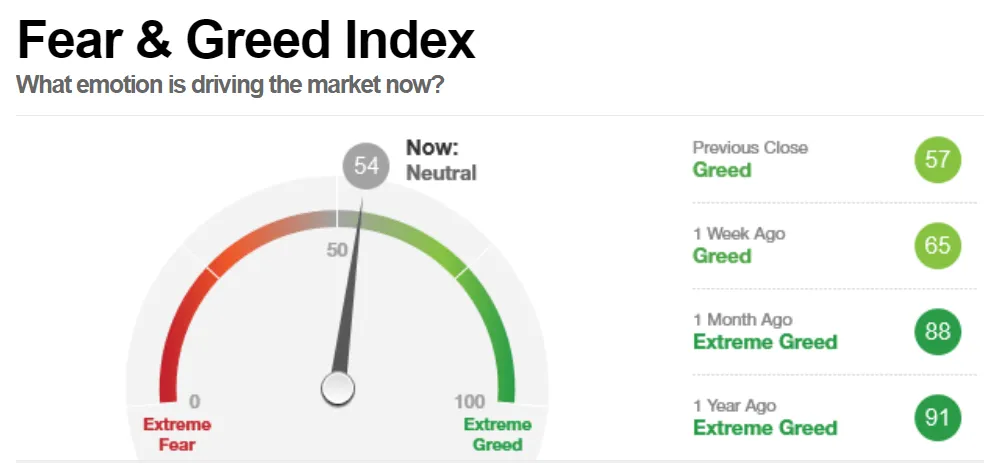

Emotions play a powerful role in stock market investing and often determine success or failure more than knowledge or strategy. Feelings like fear, greed, overconfidence, and panic can push investors to buy stocks at high prices during market hype or sell quality investments during temporary market crashes. Fear may cause premature selling, while greed can lead to excessive risk-taking without proper analysis. To control emotions, investors should follow a clear investment plan, set realistic goals, diversify their portfolio, and avoid reacting to short-term market noise. Practicing patience, focusing on long-term fundamentals, and using tools like stop-loss orders or systematic investing can help reduce emotional decision-making and lead to more disciplined, consistent returns over time.