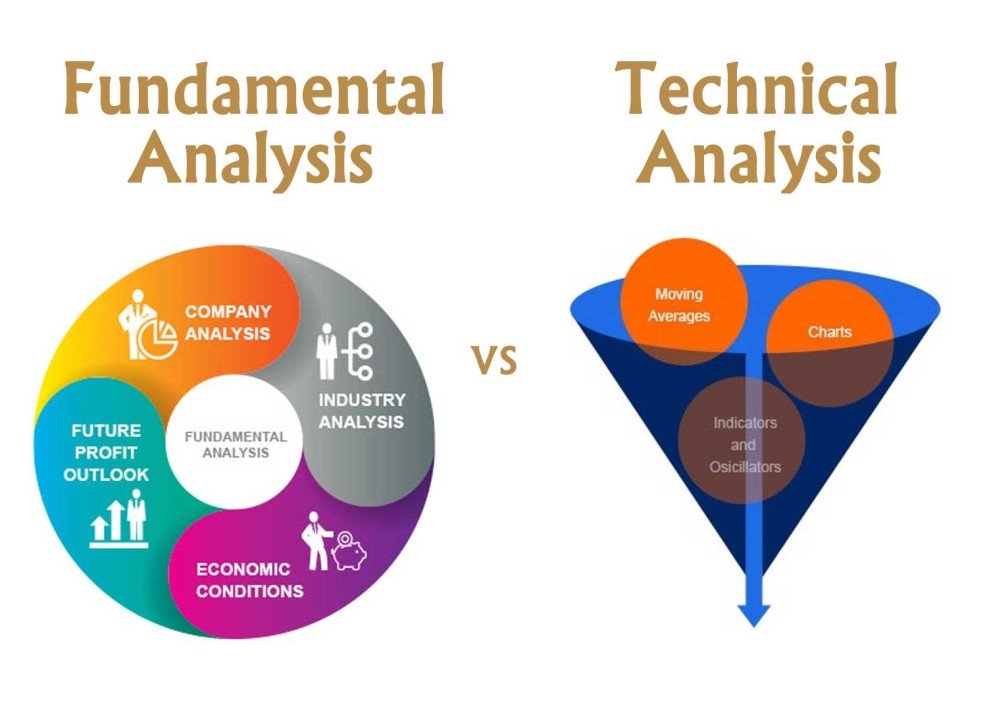

Fundamental analysis and technical analysis are two widely used approaches in stock market investing, each serving different investor goals. Fundamental analysis focuses on a company’s financial health, including revenue, profits, balance sheets, industry position, and economic factors, making it ideal for long-term investors who seek value and sustainable growth. In contrast, technical analysis studies price movements, charts, patterns, and indicators to predict future price trends, which is more suitable for short-term traders aiming to time market entries and exits. Rather than choosing one over the other, many successful investors combine both methods—using fundamental analysis to select strong stocks and technical analysis to decide the best buying or selling moments—creating a balanced and informed investment strategy.